Introducting The Jock Tax Calculator

AFP Tax is proud to launch the revolutionary Jock Tax Calculator. This tool provides professional athletes and their representatives with the ability to instantly compare and assess contract proposals from multiple teams to understand how much the player will take home depending on their individual tax situation.

Background on the Jock Tax

Athletes pay tax on their total income in the country, state, and sometimes the city or county they are considered residents of. Additionally, professional athletes are subject to tax on their earnings in each away location they play as nonresidents. Because that income is being ‘double taxed,’ that nonresident tax is often allowed as a credit in their state of residence up to the amount paid on that ‘double taxed’ income in their resident state. Because each team has a unique schedule, each team provides their players with a different tax situation.

Fully Customizable One-to-One Comparison

Each contract for an athlete can be structured in a way that is unique and the structure can influence the overall net value. Many factors can impact how much a contract is worth in a specific scenario such as where the player establishes residency, escrow, time value of money, contract structure, filing status, and the amount paid in union dues. The one-to-one comparison tool allows all those factors to be accounted for.

It is easy to look at the tax situation of NHL or AHL team (with more on the way!) by having the app assume the athlete will establish residency where the team is located. However, with proper planning, an athlete and their representatives might strategically plan to have them establish residency in a more favorable situation, such as avoiding living in New York City while playing for the New York Rangers.

You can then compare the same contract with a different team. In addition to this, you can compare two scenarios with the same team by adjusting the contract structure or determine the impact a difference in residency might have.

Once you have entered all your inputs, hit the calculate button and display the results!

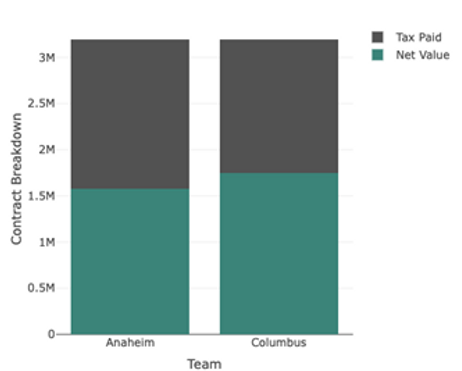

A table comparing two teams will be generated that shows the net contract value, how much more the contract would be worth with a comparison team, such as Columbus, and the amount Columbus could offer to have the athlete take home the same $1,574,778.82 Anaheim would provide and vice versa.

Compare All Teams at Once

There is also an option to compare all teams in a league at once. Just like the one-to-one comparison previously discussed, everything is customizable with the exception of residency, where it is assumed the player will live in and be a resident of the country, state (or province), and city (if applicable) of where the team is located.

Future Additions

The Jock Tax Calculator is still growing in its capabilities. Adding a cost-of-living factor, European countries, and more professional sports are in the works!

Wrap-Up

Not all decisions are purely financial but understanding the cost of choosing one situation over another is important.

The Jock Tax Calculator can be accessed via subscription. If we already work with you or your clients, please contact us to gain access. For anyone new who is interested in subscribing the cost of a one year subscription is $1,250, which provides access and technical support. If you are interested in utilizing the calculator or have questions regarding the Jock Tax Calculator, you are welcome to reach out to us.