Jock Tax Sacks Garoppolo’s New Deal

- Feb 13, 2018

- 7 min read

Jimmy Garoppolo’s five year, $137.5 million contract is being touted as the largest contract signed in National Football League (NFL) history, however a closer look at the contract indicates that it falls just short of David Carr’s and substantially below that of Mathew Stafford’s recently signed deals when comparing the the three contracts in terms of their true value.

49ers Avoid the “Kirk Cousins” Route

In order to keep Garoppolo the 49ers had two distinct options. First, the 49ers could sign Garapollo to a long-term contract using both David Carr’s and Matthew Stafford’s recent contracts to judge the current market place or second the 49ers could choose to follow the Washington Redskins approach with Kirk Cousins, using the Franchise Tag and retaining Garoppolo on a year-by-year basis.

Had the 49ers used the franchise tag on Garoppolo, the team would have paid him approximately $23.5 million this upcoming season. If they had utilized the franchise tag a second season, the amount would have been approximately $28 million. A third consecutive franchise tag would have likely come at a price tag of approximately $35 million. All money from the franchise tag would be fully guaranteed. Players may not like receiving the franchise tag as it only provides financial certainty on a season-by-season basis, but it provided Garoppolo with leverage in this situation. The total amount Garoppolo would have been guaranteed under the franchise tag in the next three seasons would have amounted to approximately, $86.5 million. Therefore, Garoppolo was able to leverage the threat of the Franchise Tag and command a guaranteed amount at or near this number.

Garoppolo’s contract structure can be seen in Table 1 below. It is interesting to note the payout in the first three years is $86,400,000 and all but $3,000,000 of that is guaranteed. The remaining two years of Garoppolo’s contract can be easily bought out by the team.

Table 1

The contract structure is courtesy of spotrac.com

Based on the analysis above, this contract structure is not surprising. It provides Garoppolo with more security than a year-by-year franchise tag would and it allows the 49ers the possibility of moving on from Garoppolo in three seasons. It also provides the 49ers with future cap hit certainty that the franchise tag would not provide due to the likelihood of other teams giving their quarterbacks skyrocketing salaries.

Garoppolo’s tax situation

Professional athletes must pay state taxes on the portion of salary earned in every state they play, often referred to as ‘Jock Taxes,’ in addition to the taxes they will owe in their state of residency. Residents are then allowed to take taxes paid to other states as a credit in their state of residence, up to their residence state’s tax rate. Players are considered a resident of the state where they have spent the majority of their time in the year and have their closer economic ties. In the NFL, players are only required by contract to spend approximately 160 days, or less than half the year, with their team, thus the maximum number of days they will spend in the state where their team is located. Players will also spend more time outside of their team’s state when they travel for away games.

Where is Garoppolo a Resident?

During the 2018 season, the 49ers will play six of their eight road games outside of California and will likely spend three days away on each of those trips. This means the maximum number of days Garoppolo will be required, by contract, to spend in California is 142. A playoff run in any subsequent season could push Garoppolo to spend more than half the year in California. For all calculations it was assumed Garoppolo would be required by contract to be employed for 160 days each season. In subsequent seasons, an educated assumption was made as to how the 49ers’ schedule would be composed.

The 49ers may expect Garoppolo to spend a majority of his time in California. However, it would be wise for Garoppolo to spend as little time as possible in California and maintain his residence in his home state of Illinois.

Table 2 below shows Garoppolo’s net income for the life of his contract, looking at the difference in his potential residency. It is important to note the below calculations are based on the new tax law and it’s assumed Garoppolo will utilize the standard deduction and remain single for the life of his contract.

Table 2

Even though Illinois’s tax rate is 8.35% lower than California’s, Garoppolo will still spend the majority of each season in California. By allocating 89% of his total salary into California at their 13.3% tax rate, he benefits from Illinois’ lower tax rate on the remaining 11% of his income thus saving $521,364 over the life time of the contract.

The Impact of the New Tax Law

Much has been made of the new tax law, which will go into effect for 2018. Below are Table 3.1 & 3.2, looking at the differences in net income for Garoppolo’s contract based on his residency and tax law. Garoppolo serves as a perfect case study for how the loss of state and local taxes as an itemized deduction impacts the tax liability for high earners in high income tax states.

Table 3.1

Table 3.2

Although the tax rates have been lowered, the loss of state and local tax deduction does not allow high earners to significantly reduce their federal adjusted gross income as they did before with itemized deductions, thus resulting in a higher overall tax liability for high earners in high income tax states. The fact that the difference in California is $500,000 than that of Illinois perfectly exemplifies this phenomena.

CONTRACTS IN TERMS OF TRUE NET VALUE

Though media outlets report the terms of player contracts in gross dollars and agents are paid to maximize the overall contract value for their clients, these numbers are not truly indicative of a contract’s actual pay-out. To determine the true (or actual) value of a contract, the net present value formula represents the best approach in determining the actual value received by the athlete.

While the gross value of player contracts is easily obtainable, determining the net present value or true value takes considerable analysis. In order to determine the true value, there are two items which need to be taken into consideration – tax liability and the time value of money.

Tax Liability

While all athletes incur federal tax liability on their earnings, their exposure to state and local taxes will be directly impacted by their team’s home and away schedule.

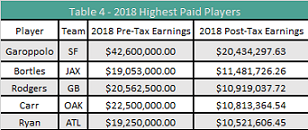

Next season, Garoppolo’s salary nearly doubles all other player in the NFL and his post-tax earnings mirrors those results. Table 4 below shows the pre and post earnings of the league’s highest paid players for next season.

Table 4

Garoppolo’s massive earnings’ advantage is the reason Garoppolo sits atop the list. However, Blake Bortles, whose current salary ranked fifth in the league, moves up to second behind only Garoppolo once you consider his Florida residency and no state tax. Bortles will also only pay ‘Jock Taxes’ for four away games next season. It’s interesting to note that along with Bortles, Rodgers and Ryan will all be entering the last year of their contracts and are potentially in line for a significant pay raise.

Time Value of Money

The general principle that states: the value of a dollar received today is more valuable than a dollar received tomorrow – because of the ability to invest that dollar, plays a significant role in analyzing the overall value of a long-term contract.

Over the past year, Garoppolo, Derek Carr and Matthew Stafford have received nine figures over five-years. It appears this contract structure might be the baseline for subsequent quarterback contracts. Kirk Cousins is likely to join this club soon and Matt Ryan, Aaron Rodgers, Drew Brees, and Case Keenum, could be close behind.

When comparing these five-year contracts, timing is everything. Although all three of Stafford, Carr, and Garoppolo are under contract for the next five seasons, Stafford and Carr received their signing bonuses last year while Garoppolo will be receiving it this year. The contract payment structures are also different.

In order to create an apples-to-apples comparison, the after-tax value of all the contracts were converted into today’s dollars. For Carr and Stafford, their signing bonuses were brought into today’s dollars using the future value formula. All other amounts were converted into today’s dollars using the present value formula. For all formulas, a discount rate of 7.83% was used, which has been the return of a balanced portfolio over the past five years.

Below is Table 5, with the value of each of the three players’ contract value, after tax, in today’s dollars. One interesting wrinkle is Derek Carr’s likely relocation from Oakland, California, the highest income tax state, to Las Vegas, Nevada, an income tax free state.

Table 5

Despite what many are touting a record-breaking contract for Garoppolo, his after tax present value earnings pale in comparison to those of Matthew Stafford’s. Stafford received $50,000,000 a year before Garoppolo and benefits from paying much lower state and local taxes. The impact of Carr’s likely relocation to the income tax free state of Nevada and his signing bonus earnings last year are what propels his after tax present value ahead of Garoppolo, despite having a contract that pays him $12,500,000 less.

Conclusion

Jimmy Garoppolo serves as a perfect example of the importance of proper tax planning. Understanding and navigating the complex multi-state tax issues could potentially save Garoppolo $500,000 in tax liability over the course of his contract. Kirk Cousins and other quarterbacks in line for a big payday should also understand the complexity of these issues as choosing one team over another can have a major impact on a player’s net earnings.

It was thought that Garoppolo had set a new bar, but in reality, he failed to clear the bar set by Matthew Stafford. It will be interesting to watch the new quarterback contracts that will be signed over the next year to see what bar they clear. Players and their agents should be looking to clear Garoppolo’s contract gross value and Stafford’s net value on a five year contract.

KYLE STICH is the Director of AFP Analytics. In addition, Mr. Stich is a tax specialist and Director of Operations at AFP Consulting LLC, whose clientele include professional athletes performing services on three separate continents. Mr. Stich earned his Master of Science in Sport Management with a Concentration in Sport Analytics from Columbia University in 2017. He earned his undergraduate degrees in Accounting and Sport Management from St. John Fisher College in 2015, where he currently serves as an adjunct professor teaching Sport Finance and Baseball Analytics.

ALAN POGROSZEWSKI is an Associate Professor of Sports Studies at St. John Fisher College and the President of his own tax consulting business whose clientele include professional athletes performing services on three separate continents. Prior to accepting his position at St. John Fisher College, Mr. Pogroszewski was the Vice President of Business Operations for Sports Consulting Group, a firm that specializes in the representation of professional hockey players. Mr. Pogroszewski received his M.B.A. from Rochester Institute of Technology in 1996 and his M.S. in Taxation from St. John Fisher in 2003.

Comments